The global Mobility as a Service (MaaS) market is on the cusp of an extraordinary surge, projected to reach a staggering USD 1,441.30 billion by 2030. This monumental growth, highlighted in a new report by Grand View Research, Inc., represents an impressive CAGR of 39.3% from 2023 to 2030. This isn't just growth; it's a revolution in how people move.

Driving Forces Behind the MaaS Boom

The escalating demand for on-demand transportation services is a clear signal: consumers are prioritizing immediate, hassle-free travel experiences tailored to their schedules. MaaS is perfectly positioned to meet this need, seamlessly integrating various transportation modes into a single, cohesive platform.

Another significant catalyst is the pervasive adoption of mobile devices. With smartphones practically glued to our hands, accessing and interacting with MaaS platforms has become effortless. Users can effortlessly plan, book, and manage their transportation needs through intuitive applications, making mobility more accessible and convenient than ever before. These platforms effectively consolidate diverse user needs into a single, user-friendly interface.

Furthermore, the rapid economic expansion in emerging economies is creating fertile ground for MaaS growth. As urbanization accelerates and disposable incomes rise, so does the demand for efficient, convenient, and sustainable transportation solutions. MaaS emerges as a transformative concept in these regions, addressing evolving mobility demands, offering integrated services, and even catering to previously unfulfilled needs due to infrastructure gaps.

Get a preview of the latest developments in the Mobility As A Service Market; Download your FREE sample PDF copy today and explore key data and trends

Navigating the Pandemic's Impact and Future Recovery

The initial outbreak of the pandemic undeniably cast a shadow over the MaaS market. Travel demand plummeted as people stayed home, leading to a significant reduction in MaaS utilization. The widespread closure of businesses, entertainment venues, and educational institutions further curtailed the need for daily commuting, impacting the frequency of MaaS usage. While the early stages presented formidable challenges, the industry is now firmly poised for a gradual and robust recovery, demonstrating its inherent resilience and critical role in future urban mobility.

Mobility As A Service Market Report Highlights

- The payment solutions segment is expected to grow at a significant rate. Integrating secure and seamless payment mechanisms directly within mobility as a service applications simplifies the transaction process and enhances user experience. Moreover, the payment solutions support domestic and international users, thus serving a broader user base

- The ride-sharing services segment is expected to witness significant growth. Many cities are implementing policies encouraging ride-sharing as part of their urban planning and sustainability efforts. These initiatives include dedicated lanes, incentives, and regulations that promote ride-sharing services, fostering their growth and utilization

- The private transportation segment is expected to grow at a significant CAGR over the forecast period. Mobility as a service platforms are witnessing a surge in adoption among individuals seeking personalized and efficient private transportation options. Passengers can enjoy personal space, control over climate settings, and the freedom to engage in personal activities.

- The Electric Vehicle (EV) segment is expected to witness significant growth over the forecast period. Due to their lower operating and maintenance costs than traditional internal combustion engine vehicles, the EV segment is expected to emerge as a viable option for mobility as a service. Mobility as a service platforms can highlight the financial benefits of using electric vehicles, making them an attractive option for cost-conscious users

- The on-demand segment dominated the market in 2022. On-demand mobility as a service offers users the flexibility to opt for viable transportation options without a commitment to a fixed subscription. Moreover, on-demand services cater to spontaneous travel decisions, allowing users to book transportation immediately without planning or reservations

- The Android segment dominated the market in 2022. Android devices have a broad market presence, making them accessible to a large user base. The vast accessibility encourages more individuals to utilize Android applications for booking transportation, as it aligns with the prevalent mobile ecosystem.

- The Peer-to-Peer (P2P) segment is expected to witness significant growth. Peer-to-peer (P2P) mobility as a service optimizes existing transportation resources by enabling individuals to share their vehicles with others during their daily commutes or trips. Moreover, vehicle owners can offset their vehicle expenses by sharing rides, while passengers can access affordable transportation options compared to ride-hailing services

- The government segment is expected to witness significant growth. Mobility as a service can help enhance government services and improve urban transportation. Moreover, mobility as a service platform can adapt to emergencies and provide alternative travel options during disasters, ensuring the smooth movement of people and resources

- The Asia Pacific region is expected to grow significantly, spurred by a high population density intensifying transportation challenges. A rise in investments to improve transportation infrastructure, including public transit, creates an environment conducive to mobility as a service adoption. Moreover, young demography and expanding digital initiatives in the Asia Pacific region are expected to drive the growth of the MaaS market

Mobility As A Service Market Segmentation

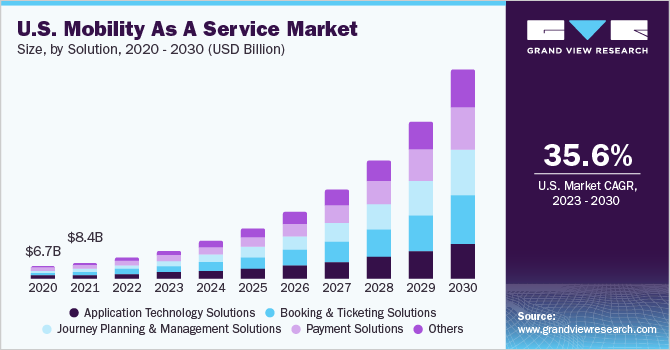

Grand View Research has segmented the global mobility as a service market based on solution, service, transportation type, propulsion type, payment type, operating system, application, end-user, and region:

Mobility As A Service Solution Outlook (Revenue, USD Billion, 2017 - 2030)

- Journey Planning & Management Solutions

- Payment Solutions

- Booking & Ticketing Solutions

- Application Technology Solutions

- Others

Mobility As A Service Outlook (Revenue, USD Billion, 2017 - 2030)

- Ride-hailing Services

- Ride-sharing Services

- Micromobility Services

- Public Transport Services

- Others

Mobility As A Service Transportation Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Public Transportation

- Private Transportation

Mobility As A Service Propulsion Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Internal Combustion Engine (ICE) Vehicle

- Electric Vehicle (EV)

- Compressed Natural Gas (CNG)/Liquefied Petroleum Gas (LPG) Vehicle

Mobility As A Service Payment Type Outlook (Revenue, USD Billion, 2017 - 2030)

- On-demand

- Subscription-based

Mobility As A Service Operating System Outlook (Revenue, USD Billion, 2017 - 2030)

- Android

- iOS

- Others

Mobility As A Service Application Outlook (Revenue, USD Billion, 2017 - 2030)

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Peer-to-Peer (P2P)

Mobility As A Service End-user Outlook (Revenue, USD Billion, 2017 - 2030)

- Automotive

- Government

- Healthcare

- Retail

- Entertainment

- Others

Mobility As A Service Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Kingdom of Saudi Arabia (KSA)

- UAE

- South Africa

Curious about the Mobility As A Service Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.