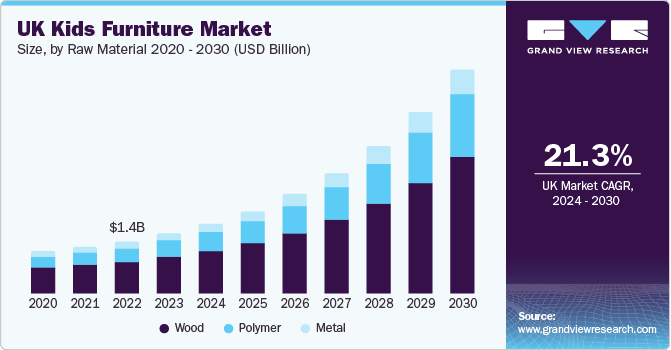

The UK kids furniture market was valued at an estimated USD 2.01 billion in 2023 and is poised for substantial growth, with a projected compound annual growth rate (CAGR) of 21.3% from 2024 to 2030. This upward trend is significantly influenced by the increasing demand for residential furniture across the country. Many market participants in the UK have strategically shifted their production to other countries, aiming to reduce manufacturing costs and boost operational efficiency. Furthermore, the growing momentum of housing renovations, a heightened demand for residential dwellings, and the popular trend of dedicating a separate room for children are all positively impacting market expansion. In 2023, the UK kids furniture market represented a 4.00% share of the global kids furniture market.

Educational furniture is playing a crucial role in shaping dynamic learning environments that foster students' physical well-being. A consistent demand for ergonomically designed products—aimed at preventing health issues and ensuring a comfortable learning space for both teachers and students—will continue to support this application segment's growth. The emergence of dynamic and interactive teaching methodologies, including blended learning and flipped classrooms, is further transforming the industry landscape.

The increasing purchasing power of the UK population is also a significant driver. According to the World Bank, the GDP per capita purchasing power parity for the U.K. reached USD 44,117 in 2020. This figure represents a notable increase from USD 28,000 in 2001, reflecting an average annual growth rate of 2.48%. This steady rise in GDP per capita purchasing power parity is likely to considerably propel the growth of the kids furniture market in the country.

Get a preview of the latest developments in the UK Kids Furniture Market; Download your FREE sample PDF copy today and explore key data and trends

The UK market benefits from a strong presence of both manufacturers and distributors, which helps keep prices competitive. Moreover, the expanding reach of online retailers is expected to drive product sales. For example, KIDSKRAFT offers a wide array of kids' furniture online, including table & chair sets, bookcases & shelves, toy boxes & benches, bin units, and kids' desks. Manufacturers are also incorporating unique features like 3D prints and theme-based furniture to make items more appealing to children. These creative approaches are anticipated to fuel market growth. A prime example is Circu Magical Furniture, which provides numerous theme-based beds for children, such as the Orient Express Bed, Mr. Bunny Bed, Tristen Bed, Dino Bed, Cloud Bed, Bubble Gum Bed, Bun Van Bed, Fantasy Air Balloon Bed, Sky Air Plane Bed, Little Mermaid Bed, Kings & Queens Castle Bed, and Teepee Room Bed. Such engaging themes attract and encourage children to utilize their furniture in daily life, which is expected to contribute positively to market expansion.

Detailed Segmentation

Product Insights

The beds, cots, and cribs segment dominated the market with a revenue share of 32.47% in 2023. Healthy sleep plays a quintessential role in the physical and emotional well-being of infants and young children. Sleep is a dynamic developmental process, especially in the first two years, and assists in promoting growth, improving learning, and increasing the attention span of babies. Consequently, there is a significant rise in the demand for kids’ cribs, cots, and beds in the country.

Raw Material Insights

Kids wood furniture market dominated the market with a revenue share of 61.69% in 2023.Increasing focus on quality furniture so as to help create the right ambience in kids’ rooms is increasing the market scope for wood-based furniture products. Wood is a highly popular material as it is environment friendly and it gives an aesthetic appearance to the furniture. According to the Wood Panel Products Federation, 28 percent of the domestically produced wood products are consumed by the U.K. furniture industry, which is similar to the round wood products consumed in the U.K. Similarly, the Timber Trades Federation estimates that 30% of its domestically produced wood is used for furniture production. This shows that wood is widely preferred to produce kids furniture in the country.

Application Insights

Usage of kids furniture in household sector dominated the market with a revenue share of more than 67.15% in 2023.The increasing number of constructions has paved the path for quality kids furniture such as beds, cribs, cots, tables, chair, shelves, and wardrobe. According to the Ministry of Housing, Communities & Local Government, it was found that the number of new homes built by June 2019 surged to over 170,000, which is the highest from the past 11 years. Almost 1,73,660 new homes were built in the U.K. in 2019, accounting for the 8% increase from the previous year. This shows that there is an increase in the residential houses in the U.K. which will likely favor the growth of the kids furniture market.

Key UK Kids Furniture Companies:

- Circu Magical Furniture

- Williams-Sonoma Inc.

- BABYLETTO

- Blu Dot

- Casa Kids

- Crate and Barrel (Crate & Kids)

- Circu Magical Furniture

- Million Dollar Baby Co.

- KidKraft

- Sorelle Furniture

UK Kids Furniture Market Segmentation

Grand View Research has segmented the UK kids furniture market report based on product, raw material, application and distribution channel:

- Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Beds, Cots, & Cribs

- Table & Chair

- Cabinets, Dressers, & Chests

- Mattresses

- Others

- Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

- Wood

- Polymer

- Metal

- Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Commercial

- Household

- Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

- Online

- Offline

Curious about the UK Kids Furniture Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In October, 2023Pottery Barn Kids, a manufacturer of kid’s furniture bedding, décor and accessories acquired Williams-Sonoma Inc.

- In June 2021, Williams-Sonoma, Inc. announced the return of a partnership with The Trevor Project, the world’s largest suicide prevention and crisis intervention organization for lesbian, gay, bisexual, transgender, queer, and questioning (LGBTQ) young people. The organization provides support to LGBTQ youth through free and confidential crisis services. As part of the partnership, Pottery Barn, Pottery Barn Teen, Mark & Graham, West Elm, and Williams Sonoma will sell exclusive products that benefit the organization.